Calculation of deferred tax on depreciation

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Cornerstone Combines The Power Of 1031 Securitized Real Estate.

Net Operating Losses Deferred Tax Assets Tutorial

When calculating deferred depreciation remember the following points.

. Suppose the depreciation as per Companies Act is 200000 and according to IT act is 400000. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Calculate And Compare A Normal Taxable Investment To Two Common Tax Advantaged Situations.

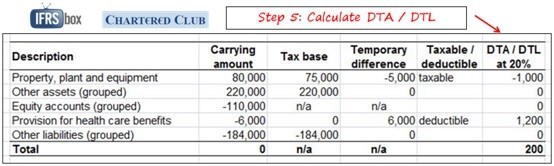

Assume tax rate of 20 and no temporary differences other than those stated above. Depreciation rate as per the Income Tax Act 15 For the financial year 2020-21 the company also generated a revenue of Rs. However it is the profit in accounting base so we have to make adjustment to determine.

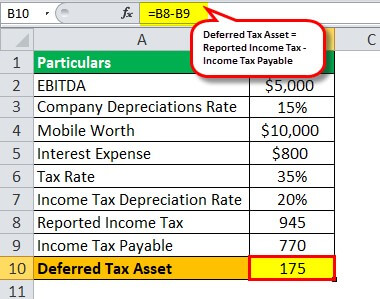

In the given situation excess tax paid today due to the difference among the income computed as per books of the company and the income computed by the income tax authorities is 1260000. The tax book and associated. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

1000000 and had an expense of Rs. For instance company B has assets worth Rs. Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today.

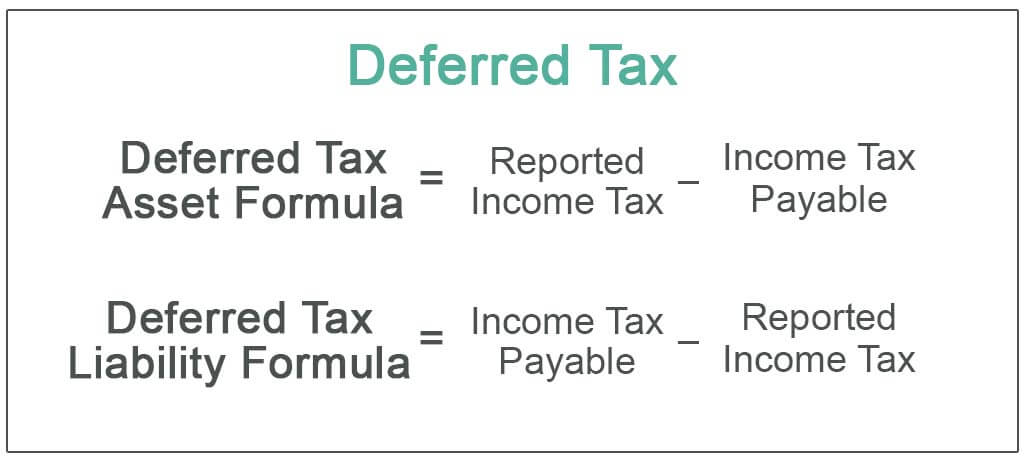

The calculation of deferred tax liability revolves around finding the difference between a companys taxable income and account earnings before taxes multiplied by its. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Deferred tax expense for current year 1500 1500-0 The company profit before tax is 50000.

Project depreciation expense and use those values to determine future income tax liability. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. ABCs tax loss carried forward.

60000 on which it calculates 10 depreciation whereas as per the IT department depreciation shall be calculated at the rate of 15. Step 4 Calculate the amount of any deferred tax asset that can be recognised Case Timing of reversal Case Different types of tax losses Unused tax losses and unused. By the end of an assets lifetime its total depreciation shall agree in both reports as the difference between those two figures would eventually narrow over the following years.

Calculate deferred tax as of 31 December Year 1. Ad Compare Taxable Tax-Deferred And Tax-Free Investment Growth. The temporary timing differences which created the deferred tax liabilities in years 1 and 2 are partially reversed in year 3 as the book depreciation is now higher than the tax.

Answer 1 of 4. Now this depreciation is creating a difference between the accounting profit.

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Liability Calculation Peatix

Deferred Tax Meaning Expense Examples Calculation

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

2022 Cfa Level I Exam Cfa Study Preparation

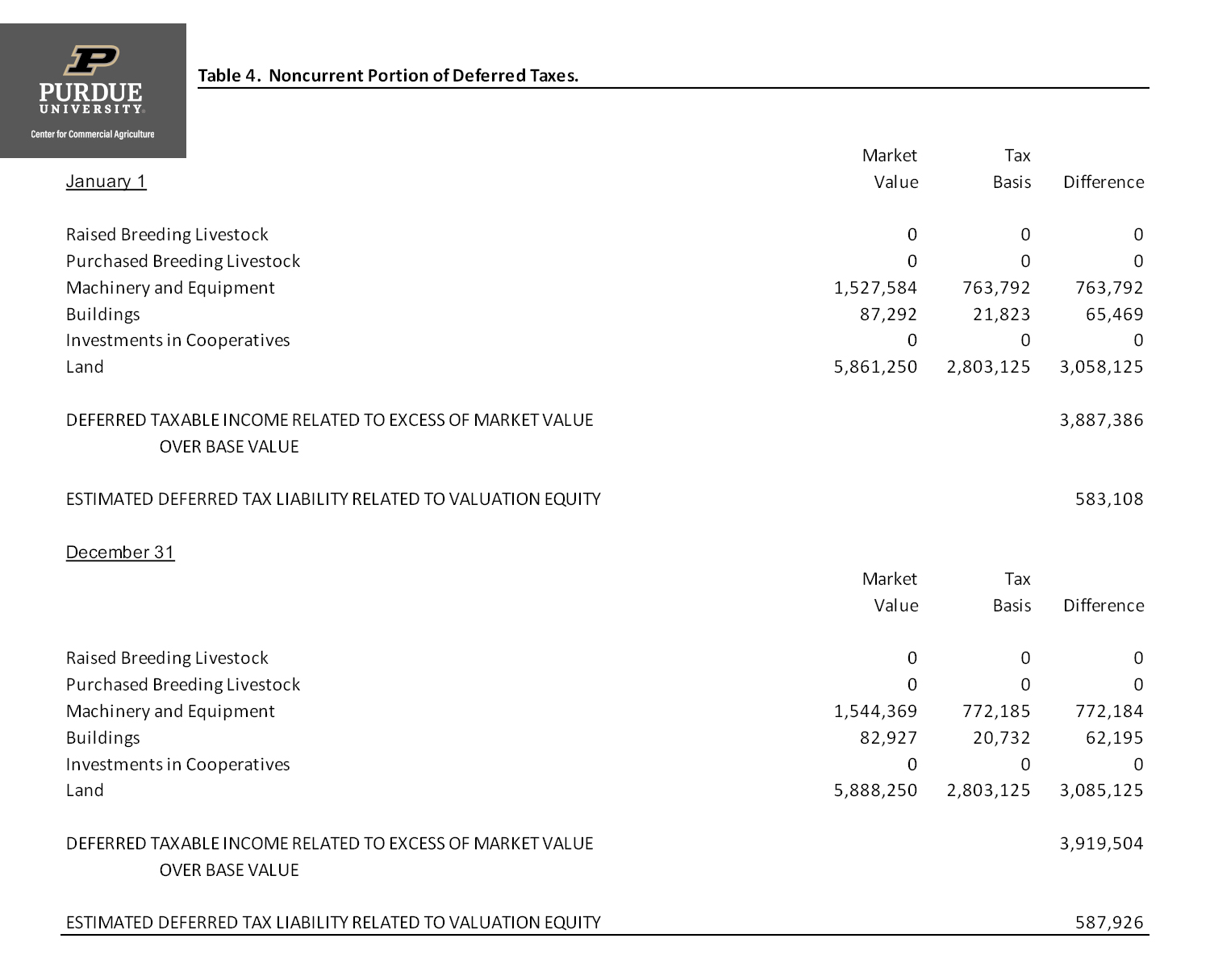

Computation Of Deferred Tax Liabilities Center For Commercial Agriculture

Deferred Tax Calculation Excel Rocktheme

Deferred Tax Double Entry Bookkeeping

Deferred Tax Meaning Expense Examples Calculation

Tax Calculation And Reporting Story Behind Sample Content Part 1 Sap Blogs

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Deferred Tax Liabilities Meaning Example How To Calculate

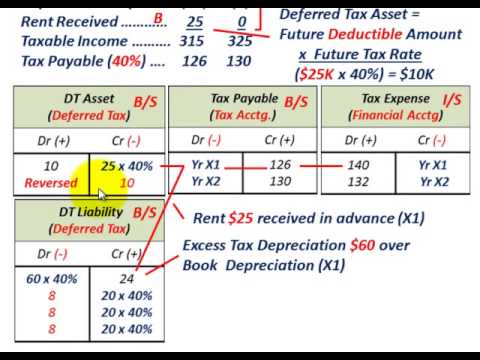

Deferred Tax Example Two Temporary Differences Deferred Tax Asset Deferred Tax Liability Youtube

Define Deferred Tax Liability Or Asset Accounting Clarified

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Deferred Taxes Modeling Accounting Concept

Deferred Tax Asset Journal Entry How To Recognize